Terms & Conditions

I give consent and authorize PFI Mega Life to use my personal data for administrative purposes, and services associated with the offering of this product/program and or other products/programs from PFI Mega Life Insurance.

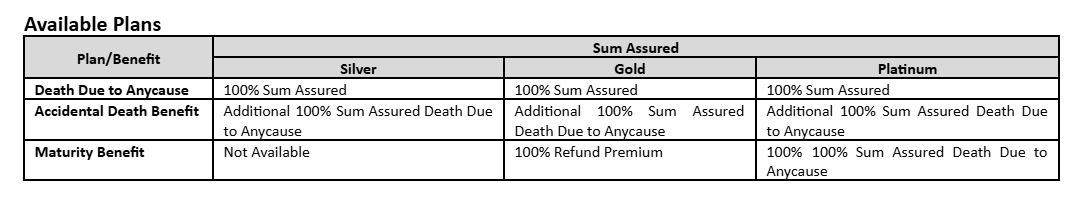

Mega Proteksi Masa Depan is an endowment insurance product that has 3 plans that have their own advantages and can be adjusted to customer needs. Mega Proteksi Masa Depan provides death benefits due to any cause, death due to accident and end of coverage benefits. Mega Proteksi Masa Depan is also equipped with Additional Insurance Benefits that can be selected according to needs.

If the Insured dies due to any cause during the Coverage Period and the Policy is active, the Insurer will pay the Sum Assured (without Cash Value) and then the Policy will terminated.

a. If the Insured dies due to an Accident during the Coverage Period and the Policy is active, the Insurer will pay additional Sum Assured (without Cash Value) and then the Policy will terminated.

b. Insurance Benefits as referred to in point (a) can be paid with the following provisions:

- The Insured dies immediately or within 90 (ninety) Calendar Days after the Accident occurs;

- Both the Accident and the death of the Insured due to the Accident must occur during the Insurance Period and the Policy must be active; and

- The death must be a direct result of and only due to the Accident.

If the Insured alive until the end of the Coverage Period and the Policy is still valid, the maturity Benefits that are formed will be paid and then this Policy will end.

Policy Holder: minimum 18 years old

Insured: 30 days – 70 years old

*Age calculation method is nearest birthday

20 years dan 30 years

Agency

IDR

Regular Premium (Annually*, Semi-Annual, Quarterly, Monthly)

*Specifically for Silver Plan, Only Annual Premium Payment Frequency applies

Mega Critical Illness Care is an additional insurance product that has Critical Illness benefits based on 3 stages of Critical Illness.

Mega Waiver Assurance is an additional insurance product that provides the benefit to waive the premium payments for Policyholders/Insured if the Insured suffers from a Critical Illness or total and Total Permanent Disability.